ASIC protects First Nations consumers from financial harm

13 Mar 2024

ASIC protects First Nations consumers from financial harm

ASIC has recognised the disproportionate financial vulnerability faced by First Nations people in Australia and has demonstrated commitment to taking steps to protect them from financial harm.

The national corporate regulator has made taking action against misconduct impacting First Nations people an enduring enforcement priority.

Over the past year, ASIC has implemented various measures to promote positive financial outcomes for First Nations people. These initiatives include the development of an Indigenous Financial Services Framework, conducting reviews, and taking action against potential misconduct to protect First Nations Australians from financial harm.

This article summarises ASIC’s recent work over the past year to address gaps in the financial services industry that have adversely and directly impacted the financial security of First Nations people.

ASIC’s Framework to help First Nations people

In February 2023, ASIC released the Indigenous Financial Services Framework.

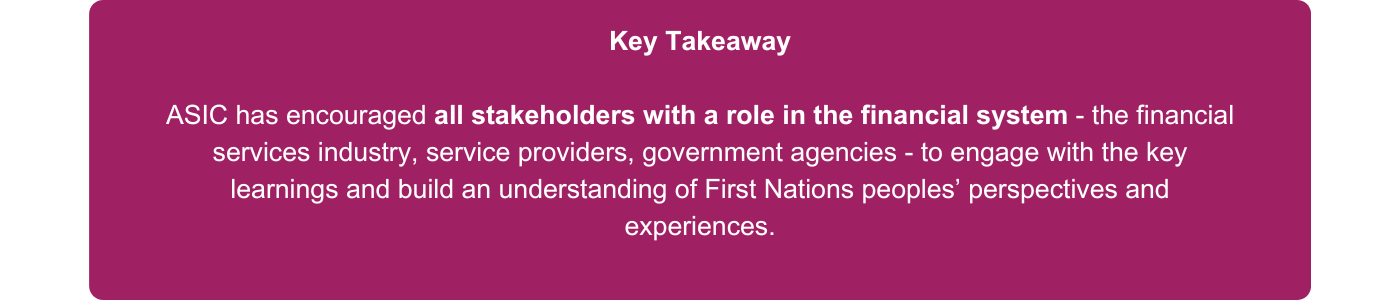

The Framework was developed in response to the number of First Nations people who are adversely affected by misconduct in the financial services industry. It was the result of an extensive consultation process with a range of key stakeholders, including First Nations consumers and communities.

The Framework outlines how ASIC will use the key learnings to inform its work and priorities relating to First Nations consumers. These key learnings include the following:

ASIC acts to ensure better banking outcomes for Indigenous consumers

In an effort to engage with and develop better banking and financial outcomes for First Nations people, ASIC undertook the Better Banking for Indigenous Consumers Project, which reviewed target market determinations (TMDs) for both high-fee and low-fee ‘basic’ accounts offered by some of Australia’s major and regional banks. ASIC published the results of its review in July 2023.

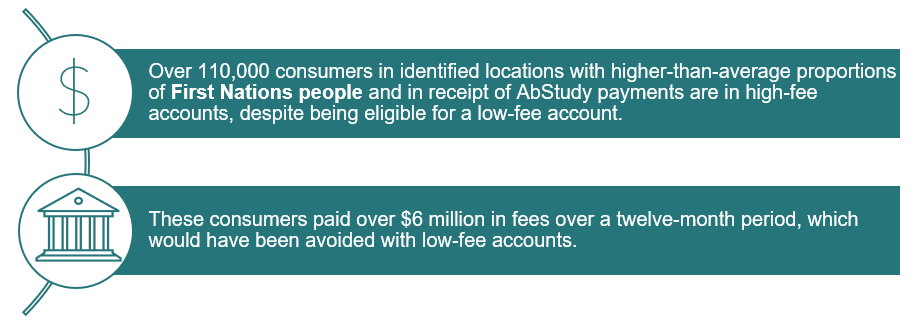

The review found that many First Nations consumers were paying up to $3,000 in overdraw fees annual in high-fee transaction accounts, despite being eligible for a low-fee “basic” account.

The review revealed that:

ASIC wrote to banks with its expectations and key findings, including outlining the reasons for banks to:

- migrate all eligible transaction account customers in Indigenous Pilot locations and those on AbStudy to low-fee accounts on an “opt-out” basis;

- ensure that fees are removed for new and existing customers when products are altered, and fee structures changed to remove particular fees;

- remediate impacted customers; and

- make procedural changes to tailored Indigenous services to better meet their commitments to their Indigenous customers.

ASIC sues Money3 Loans for responsible lending breaches

As well as working with financial institutions and credit providers to implement change, ASIC has taken action against those engaging in misconduct impacting First Nations people. A recent example is the commencement of legal proceedings against Money3 Loans Pty Ltd (Money3).

Money3 offers personal loans and consumer vehicle finance in Australia through direct, broker and dealer channels. In May 2023, ASIC alleged breaches of responsible lending obligations when Money3 provided finance for the purchase of used vehicles.

ASIC alleged that in the period between May 2019 and February 2021, Money3 neglected to conduct proper assessments to determine whether borrowers could fulfil their repayment obligations before entering into loan contracts for the purchase of used vehicles.

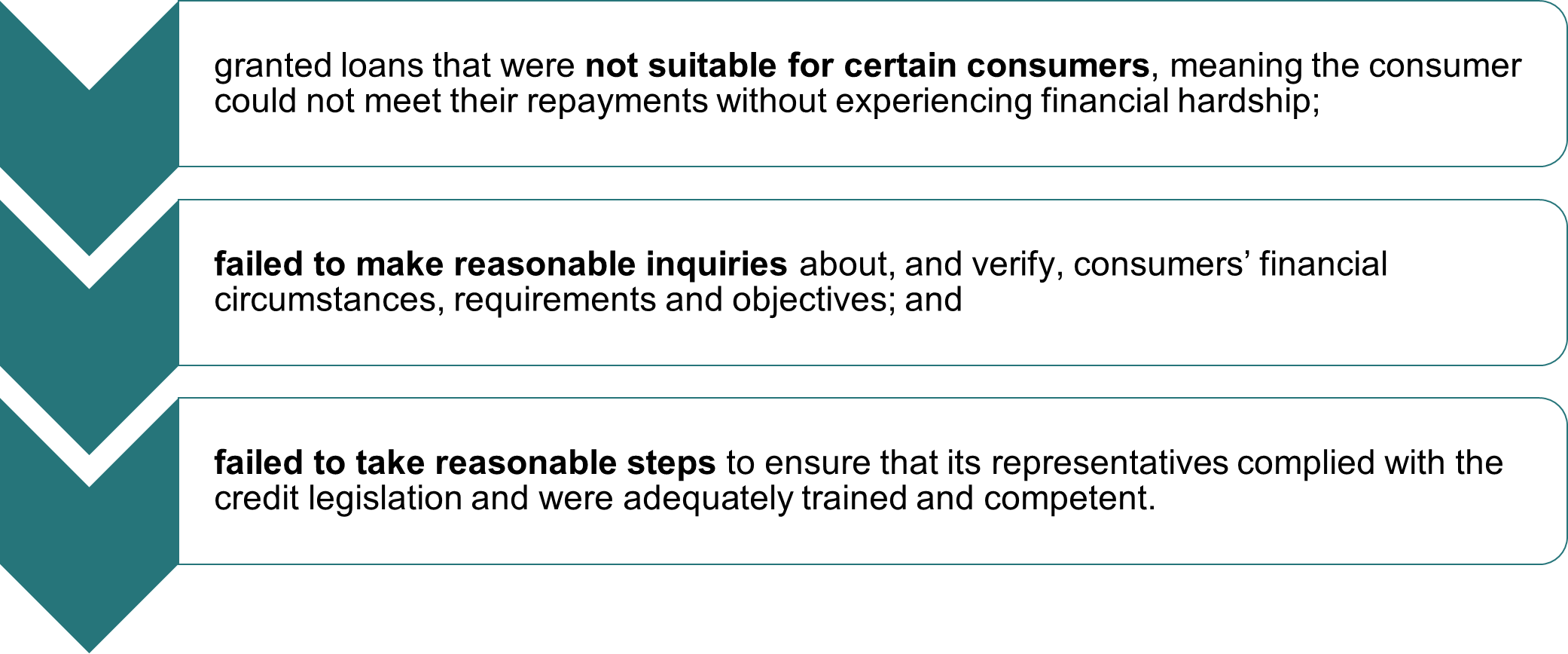

Specifically, ASIC alleged that Money3:

The targeted consumers, and a substantial proportion of Money3 customers, were either receiving Centrelink payments as their sole income or were on low incomes.

ASIC’s Deputy Chair stated that the action against Money3 was taken in response to the credit provider’s failure to consider the financial circumstances of vulnerable customers, including First Nations people.

What is the current status of the Money3 action?

Since the initiation of civil proceedings in May 2023, the matter has been listed for a number of case management hearings, with the most recent taking place on 8 February 2024. The proceedings are ongoing, and we will publish an update when they have been determined.

ASIC’s Indigenous Outreach Program

ASIC has also established an Indigenous Outreach Program, which is a specialist team working across ASIC to provide advice, insights and support to ensure ASIC’s engagement with Aboriginal and Torres Strait Islander peoples is culturally appropriate and sensitive.

The team also works with industry, service providers and other government agencies to influence system change and drive positive financial outcomes for Aboriginal and Torres Strait Islander peoples.

The Program has also participated in several consumer campaigns. This includes releasing information and resources on managing money for Aboriginal and Torres Strait Islander peoples on Moneysmart. Moneysmart is a project of ASIC that is targeted at consumers and investors.

Takeaway

We are encouraged by ASIC’s statements regarding its commitment to supporting positive financial outcomes for Indigenous consumers and the active steps it has taken in this regard over the past 12 months. However, whether these actions have any real positive impact for Indigenous consumers remains to be seen and we remain concerned that Indigenous consumers will continue to fall between the cracks as ASIC’s broader remit of protecting all financial services consumers will see it focused on issues that are not adequately targeted to the needs and vulnerabilities of Indigenous consumers.

[1] Indigenous Financial Resilience Report, 2018 which was conducted and released in partnership between the Centre for Social Impact, First Nations Foundation, and NAB.