Top tips to stay ahead of ORIC examinations

08 Sep 2025

Recent examinations by the Office of the Registrar of Indigenous Corporations (ORIC) highlight recurring areas of non-compliance amongst Prescribed Body Corporates (PBCs).

While many PBCs demonstrate strong governance practices, ORIC examinations often flag challenges in the following areas:

If left unchecked, these issues can escalate into regulatory action, including the appointment of a special administrator. In this article, we explore the ORIC examination process, share common compliance challenges, and provide practical tips to help your corporation stay on track.

Understanding ORIC Examinations

Examinations, sometimes called “healthy organisation checks”, are a regulatory power unique to the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act).

The Registrar can appoint authorised officers (called examiners) to review a corporation’s books and report back on its governance and financial health. Corporations are legally required to co-operate and provide the examiner with relevant documents.

Importantly, ORIC does not need a court order or formal trigger to start an examination; the Registrar may commence one at any time.

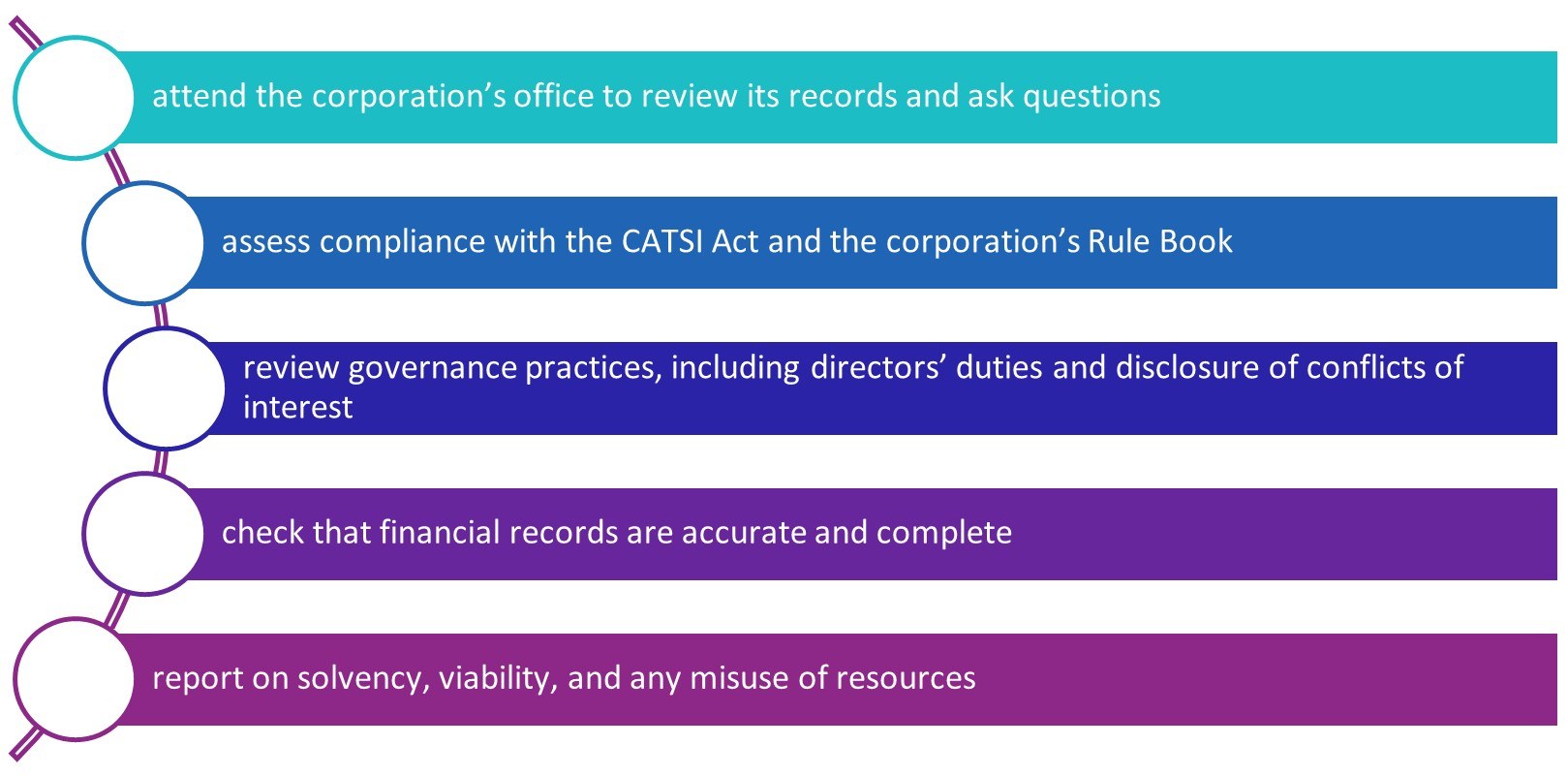

During an examination, examiners will:

At the end of the process, ORIC may issue a management letter (for minor issues), a compliance notice, or in serious cases, move towards special administration.

Examinations are carried out under a rolling program, with priority given to larger, publicly funded, or higher-risk corporations. They can also be triggered by complaints, late lodgements, or governance disputes.

Key areas of concern

Membership Decisions

Under the CATSI Act, corporations must give applicants written notice if their membership is refused, and that notice must include the reasons for the decision.

A recurring issue raised in ORIC examinations is that corporations either fail to notify applicants at all, or do not provide reasons for refusal. These gaps undermine the transparency and fairness of the membership application process, and can result in regulatory action. In some cases, a corporation’s approach to processing membership applications can become the subject of legal proceedings.

To avoid this, we recommend:

- keeping a template decision letter to help your corporation communicate membership outcomes in a timely and consistent manner; and

- documenting the resolution for each membership decision clearly in the board minutes.

It is important for directors to take the time to consider each application carefully, having regard to their directors’ duties of care and diligence and to act in good faith. To learn more about the duties of directors, click here.

Meeting Records

The CATSI Act requires corporations to keep accurate records of their meetings.

ORIC often flags unsigned or incomplete minutes during examinations, which reduces their reliability and creates concerns about accountability.

To make sure the minutes don’t slip through the cracks, you can:

- arrange for the chair to sign the minutes as soon as possible after the relevant meeting; and

- include a standing agenda item at each meeting to review and confirm that the minutes of the previous meeting are true and accurate.

Members Registers

The CATSI Act requires corporations to maintain an accurate and current register of members and former members.

Although this can be challenging when members are hard to contact, corporations must still take reasonable steps to keep records complete and reliable. Failing to keep accurate members registers can cause further compliance problems, such as uncertainty about quorum, voting rights and reporting obligations.

Some practical tips include:

- reviewing the members register at least once a year, ideally before the AGM.

- recording successful membership applications (and giving effect to any cancellations) in the register as soon as possible after the board makes its decision.

- reminding members at the AGM (and in the Notice of AGM) to update their personal details. It may help to explain why it’s important to keep accurate records.

- keeping the register of former members up to date.

- documenting all attempts to contact members, including the dates, method, and outcome. This can be particularly important if the corporation later seeks to undertake the process to cancel a membership where the member cannot be contacted.

Annual General Meetings and Director Terms

ORIC examinations have found that several corporations did not hold their Annual General Meetings (AGMs) within the prescribed timeframe. Missing or overdue AGMs can create serious flow-on effects, such as directors serving beyond their permitted terms under the CATSI Act and members losing valuable engagement and oversight.

To avoid these risks, you can:

- plan out AGM timelines early in the year and lock in dates well in advance; and

- monitor director terms in a register to prevent terms from inadvertently rolling over.

It is beneficial to contact ORIC in advance if you want to be able to hold your AGM within the required timeframe. In some circumstances, an extension of time may be permitted.

It is important to note that an unfinalised financial audit is not a sufficient reason for an extension to be granted.

Financial Management

Strong financial management is central to good governance. ORIC has repeatedly identified corporations with weak internal controls, insufficient financial policies, and overdue or missing financial reports. In serious cases, these failures have led to special administration.

To protect your corporation, it is important:

- to adopt clear financial policies and procedures, including delegated authority limits;

- where required, to engage a qualified auditor suited to your corporation’s size and complexity; and

- to ensure financial reports are lodged on time.

Key Takeaways

The outcomes of recent ORIC examinations remind us that governance obligations should not be a ‘tick box’ exercise. They shape how corporations operate, make decisions, and stay accountable to their members.

By strengthening membership processes, record-keeping, AGMs and financial reporting, corporations can reduce regulatory risk and build stronger, more effective organisations.

Assistance from Jackson McDonald

Jackson McDonald’s experienced team can assist your corporation get ahead of these challenges. Whether its streamlining record-keeping or addressing membership challenges, our team can provide practical solutions to keep your corporation compliant.

If you would like to discuss a governance health check for your Corporation, please contact our team members Emma Chinnery, Chantal Kong or Nisali Pallewela.

This article has been prepared by Nisali Pallewela, Solicitor, with input from Emma Chinnery, Partner, and Chantal Kong, Associate.