Related party benefits under the CATSI Act: the member approval process

25 Nov 2025

Under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (Cth) (CATSI Act), Aboriginal corporations may provide financial benefits to people or entities closely related to them - but only if strict procedures are followed. These arrangements are called “related party benefits”.

The CATSI Act addresses related party benefits transactions differently to the Corporations Act 2001 (Cth) (Corporations Act).

Overview

Section 284-1 of the CATSI Act requires corporations to obtain member approval before giving a financial benefit to a related party. The CATSI Act defines “financial benefit” broadly to mean anything of monetary value that gives a person some reward, profit, or advantage.

A financial benefit can include:

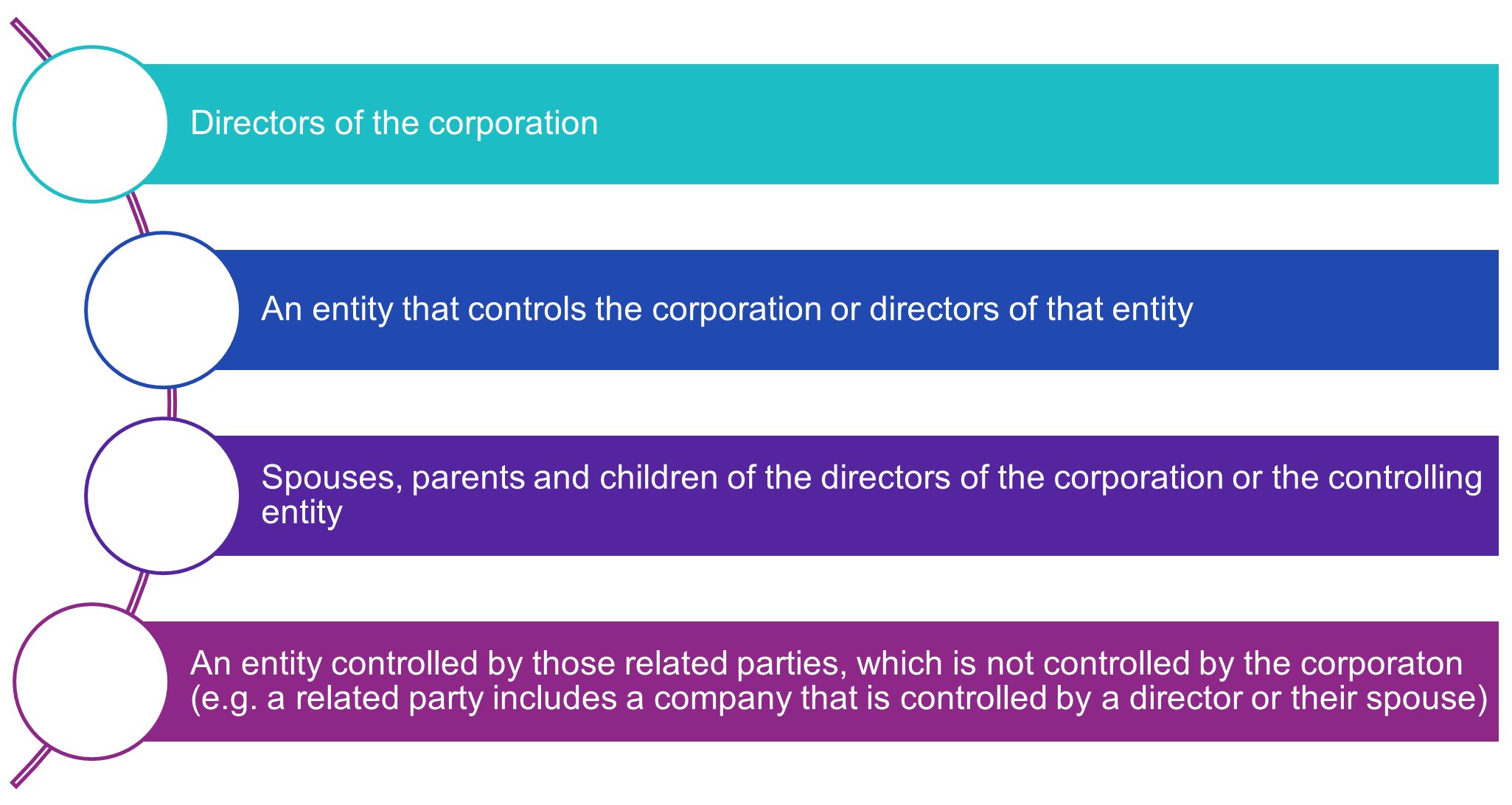

Who is a related party?

The definition of a “related party” is broad and can cover a wide range of individuals and entities closely related to the corporation, such as:

A related party also includes an entity (a person or a business) which:

- was a related party in the last 6 months;

- believes or has reasonable grounds to believe that it is likely to become a related party of the corporation; or

- acts together with a related party on the understanding that it will receive a financial benefit if the corporation gives the related party a financial benefit.

Membership Approval Process

The CATSI Act requires any related party transactions to be considered and approved by the members. This safeguard ensures that transactions are in the best interests of the corporation as a whole.

Members’ approval of a proposed transaction is achieved by ordinary resolution passed by members at a General Meeting.

Decision-making at a General Meeting

Before sending a notice of meeting to members, the corporation must lodge certain documents with ORIC at least 14 days before issuing the notice.

The documents to be lodged include:

- the proposed resolution to approve the related party transaction;

- the proposed explanatory material outlining the details of the transaction (see below); and

- any supporting documents that are to accompany the notice of meeting.

The proposed explanatory statement must set out all relevant details about the proposed transaction including:

- information about the related party (e.g. who they are and their connection to the corporation);

- the nature and value of the benefit to be provided;

- any recommendations made by the directors and their reasons;

- any interests held by directors in the proposed transaction; and

- other information reasonably required to help members decide whether the benefit is in the corporation’s best interests.

Once lodged, the ORIC Registrar has 14 days to review the materials and provide written comments.

If comments are received, the corporation must attach a copy of them to the notice of meeting that is sent to members.

The documents provided to members must be the same in all material respects as those lodged with ORIC.

Failure to lodge the documents within the required timeframe, or to include the ORIC Registrar’s comments in the notice of meeting, is an offence under the CATSI Act.

Once the ORIC Registrar’s review period has ended (and any comments have been received), the corporation must issue a written notice of meeting to all eligible persons, including members, directors, the secretary or contact person, the auditor, and any observers permitted under the Rule Book.

The notice must be given at least 21 days before the meeting date or such longer date as the corporation’s rule book may provide.

Notice must be given in the way set out in the corporation’s Rule Book (e.g. by mail, email, fax, by community noticeboard or advertisement).

The corporation must then hold a members’ meeting to approve the related party benefit.

Once members approve the benefit, the corporation has 15 months to complete the transaction and must lodge a copy of the resolution with ORIC within 28 days of the general meeting.

At the meeting, members vote by ordinary resolution. A related party, or anyone connected to them, cannot vote (in any capacity) unless ORIC grants permission.

Exceptions and Exemptions

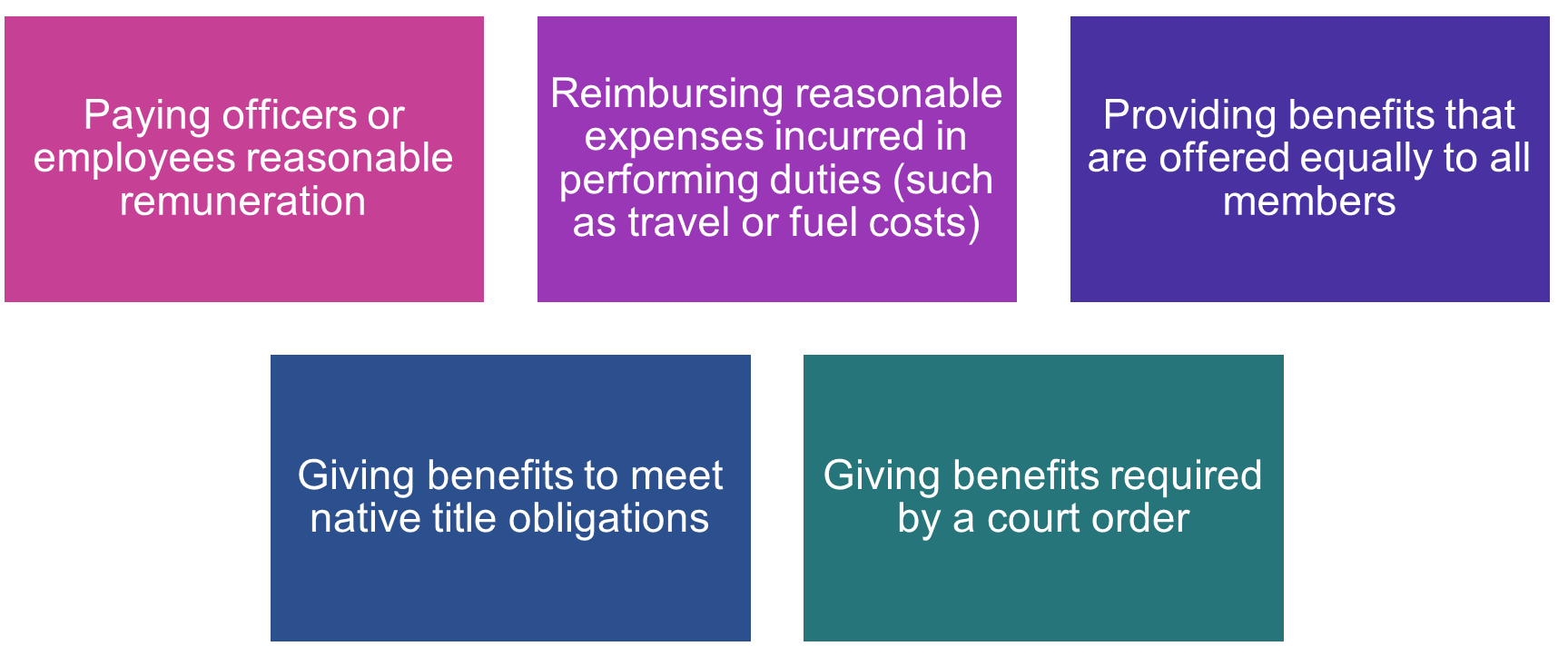

Certain related party benefits do not require member approval under Division 287 of the CATSI Act.

These exceptions include:

If there is uncertainty about whether a proposed benefit falls within one of these exceptions, the corporation can also seek guidance from the ORIC Registrar.

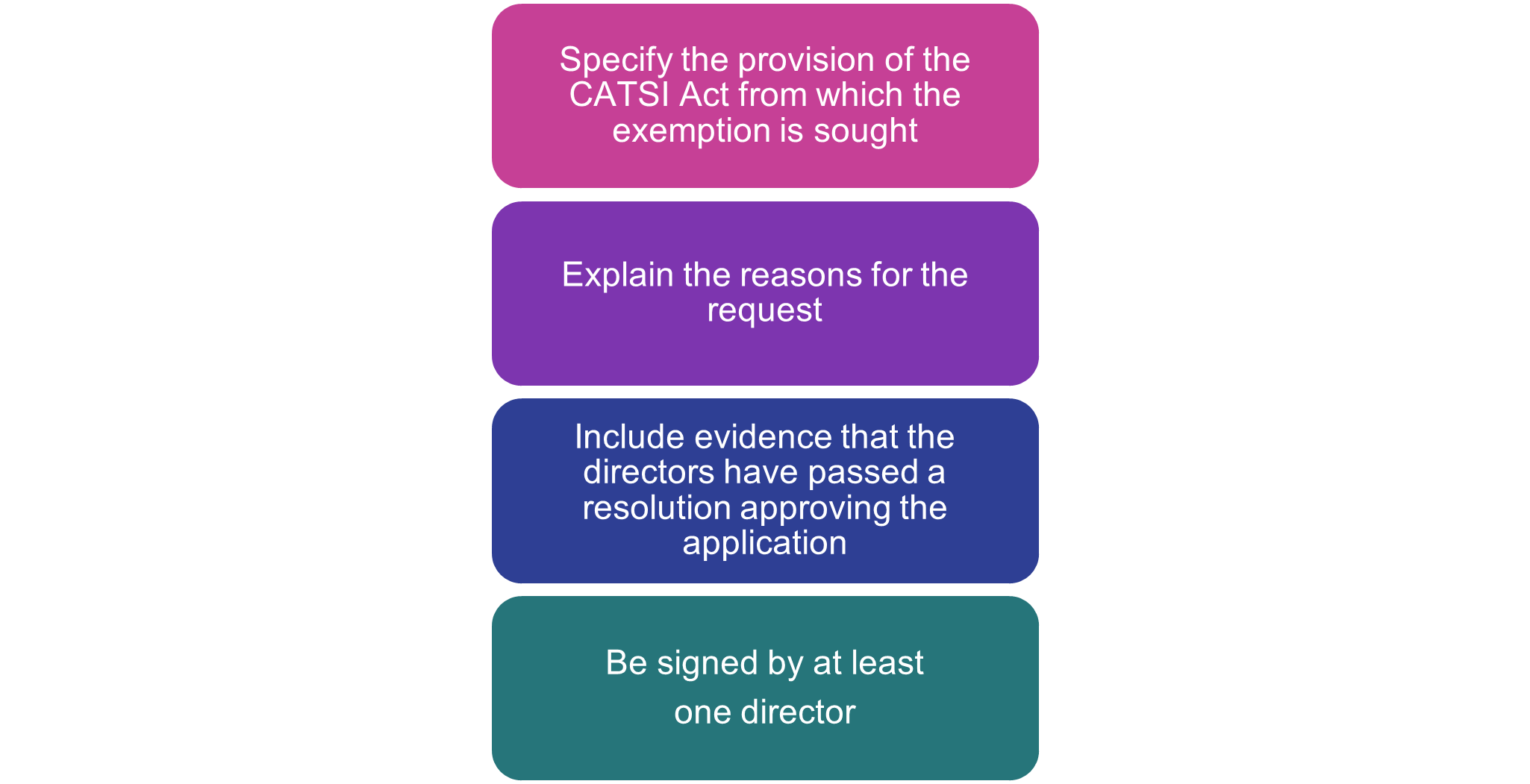

The corporation can also apply in writing to the ORIC Registrar for an exemption. The application must:

When considering an exemption application, the ORIC Registrar must be satisfied that the requirements of the CATSI Act would be either inappropriate in the circumstances or impose unreasonable burdens on the corporation.

Exemptions may apply to a single transaction or to a class of transactions, allowing flexibility while ensuring transparency and accountability.

Common Pitfalls to Avoid

Corporations can avoid problems with related party benefits by planning ahead.

To stay compliant:

- Allow sufficient time for preparation and ORIC to review the materials before issuing the notice of meeting.

- Do not send documents to members until ORIC has completed its review and you have received a response.

- Disclose all relevant information, including directors’ interests and the commercial reasons for the transaction. The CATSI Act is very specific as to the content that the explanatory statement must include.

- Ensure related parties and their associates do not vote on the resolution, unless the ORIC Registrar has granted written permission.

Assistance from Jackson McDonald

Jackson McDonald’s experienced team can assist your corporation get ahead of these challenges. Whether it is preparing related party benefits documentation or drafting member notices and explanatory statements, our team can provide practical guidance to help your corporation manage related party benefits. If your corporation is considering a related party benefits transaction, please contact Emma Chinnery or Chantal Kong.

This article was written by Ava Breton, Solicitor Corporate Commercial.