Go time for REGOs! Navigating REGOs now the GO Scheme has launched

04 Nov 2025

On Monday this week, the Future Made in Australia (Guarantee of Origin) Act 2024 (Cth) commenced. This Act establishes the framework for the Guarantee of Origin (GO) Scheme. This voluntary scheme encourages investment in decarbonisation and introduces two types of verified certificates:

- The Renewable Electricity Guarantee of Origin (REGO) certificate

- The Product Guarantee of Origin (PGO) certificate

The GO Scheme is now live with accompanying rules and regulations. Existing generators can register for the scheme now on the CER website.

The introduction of REGO certificates marks a fundamental shift in the renewable energy marketplace, designed to operate alongside the existing Large-scale Generation Certificates (LGCs) until the scheme’s expiry in 2030.

A PGO will explain where a product has come from, how it was made and its emission intensity throughout its lifetime. We will not be covering PGOs in this article but intend to go in more depth in a future publication.

In 2001, the federal government introduced a Mandatory Renewable Energy Target (MRET) of 9,500 GWh of new generation. In 2011 the MRET was split into two schemes, a Large-scale Renewable Energy Target (LRET) of 41,000 GWh for utility-scale generators, and an uncapped Small-scale Renewable Energy Scheme for commercial and household scale generators. Today, the target is 33,000 GWh and will remain in operation alongside the GO Scheme until December 2030 when the MRET ends.

What are REGO Certificates?

REGO certificates are tradable, renewable energy certificates used to certify that electricity linked to the certificate is renewable. They are created by accredited renewable energy facilities and may be traded and retired/acquitted by persons who wish to make credible claims about the quality of electricity renewable energy production and use in Australia.

REGO certificates act independently from the physical delivery of electricity. The ‘greenness’ or renewable attribute is attached solely to the certificate itself. This separation is crucial for preventing double counting of renewable energy and ‘green-washing’.

How are REGOs different from LGCs?

Both LGCs and REGOs are tradable certificates administered by the Clean Energy Regulator (CER) and represent 1 Megawatt hour of eligible renewable electricity generation.

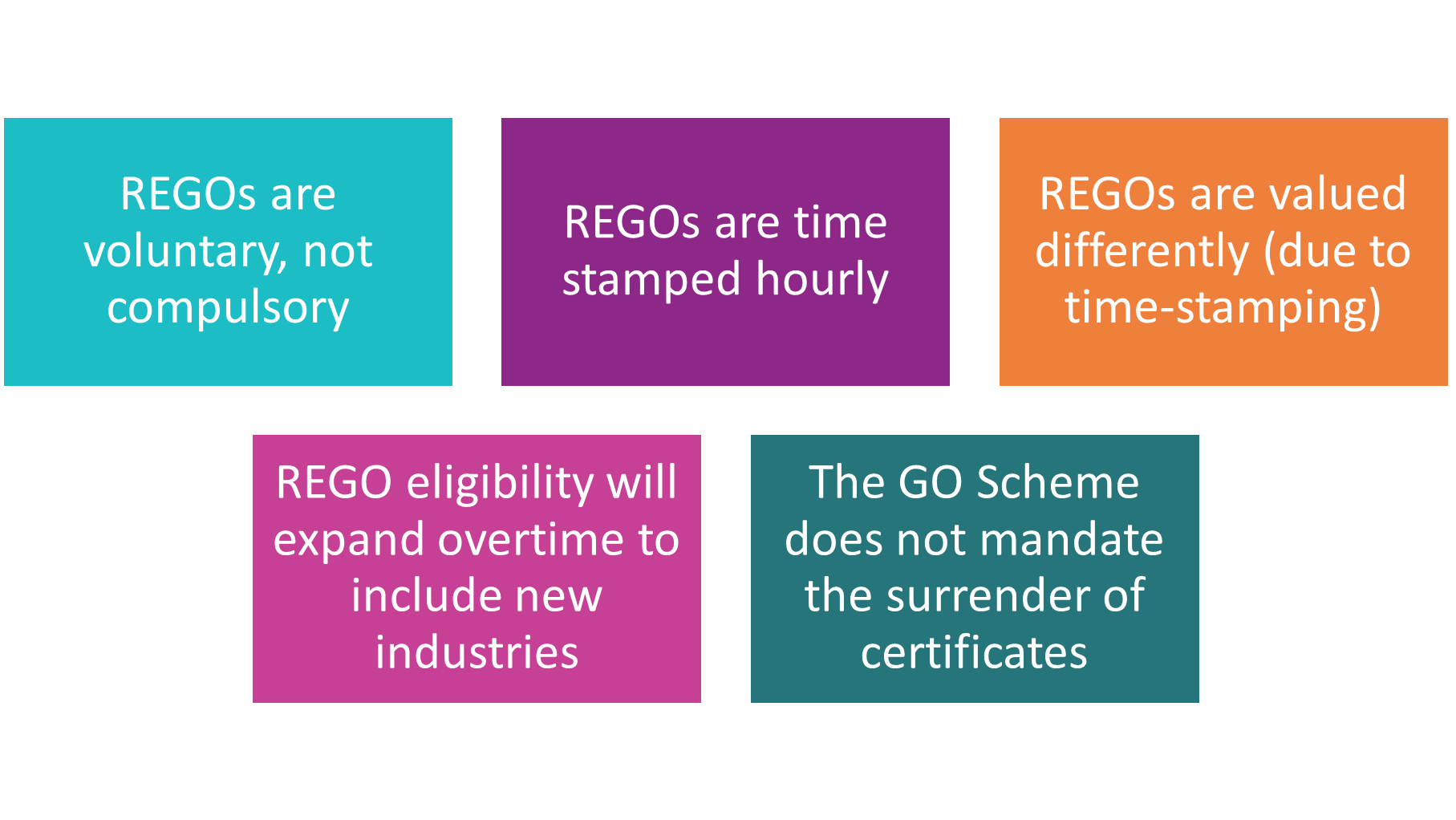

However, REGOs have the following key differences, which we think can underwrite a substantially more sophisticated carbon accounting regime:

What obligations arise under the GO Scheme?

While REGO certificates are voluntary, once an entity chooses to participate, they must adhere to defined obligations administered by the CER.

All applicants for REGO certificates must first be classified as a ‘registered person’ by CER by passing a ‘fit and proper person’ test. Eligible facilities will include accredited power stations, electricity generation systems, energy storage systems and aggregated systems (such as virtual power plants).

Once owned, REGO certificates can be traded on secondary markets. Changes to ownership must be documented on the REGO Registry.

If trading is part of a financial product, traders must ensure they hold the adequate licences or exemptions required for this activity.

Overall compliance is enforced through the CER’s oversight, including annual reconciliation checks to verify information provided by those involved in the certificate process.

The crucial role of time stamping

Each REGO certificate must be time stamped to reflect the hour during which the renewable electricity was generated or dispatched.

This granularity achieves several key benefits:

- REGOs will reflect fluctuations in the production of renewable energy. Certificates produced in key periods (such as during periods of high electricity demand and/or low renewable energy production) are likely to achieve a market price that is in keeping with that comparative scarcity compared with certificates created at times when renewable energy is plentiful and energy demand is lower.

- Better energy accounting through the purchase of certificates purchased at a specific time.

- Provides arbitrage opportunities for entities that export during demand peak periods acting as a market incentive to the development of further storage.

- Better alignment with international requirements for time-matched renewable energy generation.

REGO certificates also provide detailed information, including the age of the facility, source of fuel, location, and time of generation. They can also include other optional information that customers may value when making specific claims about their renewable energy usage.

Why might REGOs have a higher market value?

The primary mechanism that differentiates REGO is timestamping as mentioned above. Unlike LGCs, which are distinguished only by calendar year of creation, each REGO certificate records the specific hour of the day during which the renewable electricity was generated or dispatched. Certificates produced during demand peak periods will be worth more than those made during the middle of the day (for instance, being impacted by solar panel activity).

The increased granularity of information provided by REGOs, combined with the potential for price differentiation based on the time of generation, opens possibilities for a broader range of transactions. This overall sophistication and enhanced traceability is what makes a REGO certificate potentially worth more than a standard LGC.

The overlap period

The GO Scheme will operate alongside the existing MRET Scheme until December 2030, when that scheme ends. There is a 5-year overlap period where both LGCs and REGOs are available.

A crucial transitional impact is that owners of renewable facilities that currently generate LGCs must recognise that creating REGOs and LGCs for the same megawatt hour are mutually exclusive.

The introduction of the voluntary REGO scheme alongside the mandatory LGC regime creates potential complexities. If facility operators were to opt for the creation of REGOs over the creation of LGCs, it may pose an issue for their off takers and/or “liable entities” under MRET (frequently retailers) who need to meet their LGC targets. The transition could cause disruptions to the liquidity of the LGC market where both REGOs and LGCs are being traded at the same time.

However, on a positive note liable entities who have met their LGC targets however may wish to also have REGOs to strengthen their environmental position. This allows for more commercial strategy in deciding whether to create the certificate required for mandatory compliance or the potentially higher-value, data rich certificate favoured by the voluntary market and capable of capitalising on peak pricing.

We note that at this stage, the GO Scheme will remain voluntary during the overlap period and beyond, creating a unique flexible market for verifying renewable electricity generation.

Strategic considerations for energy participants

Given that the GO Scheme is slated to commence by the end of 2025, energy market participants should take immediate steps to prepare.

We recommend you:

- take steps to consider whether your facility is capable of being accredited under the GO Scheme;

- review your existing supply agreements, particularly for the ability to switch certificate products (from LGCs to REGOs);

- develop a compliance plan for the GO scheme’s obligations; and

- develop a strategic plan to determine a desired volume of both LGCs and REGO certificates.

To discuss how the REGO certificate framework will affect your commercial strategy and future projects, please reach out to our team today.

This article was written by Tegan Hill, Law Graduate, Darcy Milligan Associate and Luke O'Callaghan Partner Corporate Commercial.