Recurrence claims. They weren’t particularly easy to deal with under the old system, and there is even more to think about under the new system.

Let’s start at the very beginning (a very good place to start)

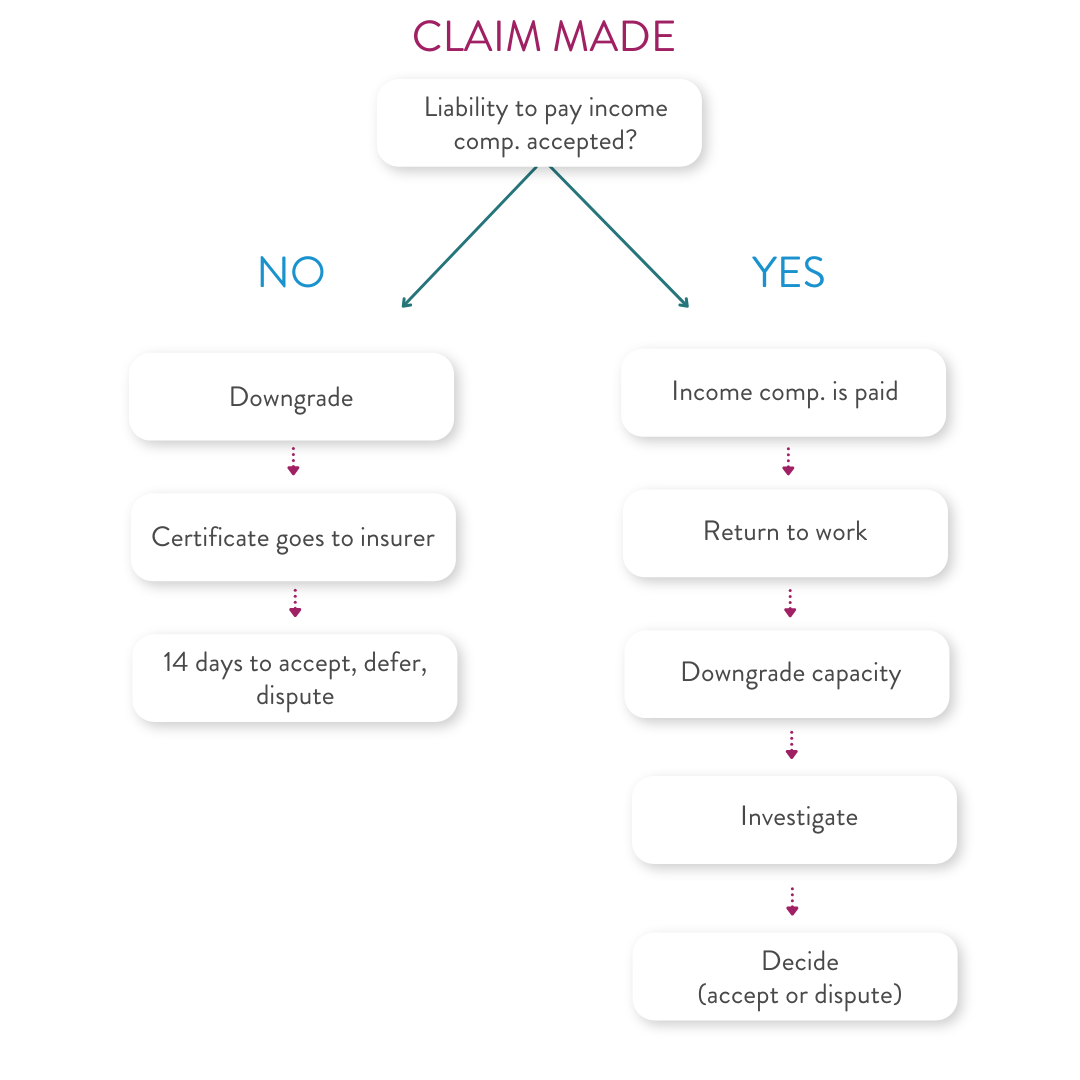

When a worker claims compensation, it is up to the employer and insurer to determine whether the claim is an “incapacity claim” or not. Don’t look at the claim form – because you won’t find the answer there!

Look at the first certificate of capacity. If the worker has full capacity for work and only requires treatment, then there is no claim for income compensation. It is a bit trickier if the worker has partial capacity (on the face of the certificate) but has actually continued working. If you’re confident they haven’t actually stopped working, then you can probably assume no claim for compensation.

When you accept liability for the claim, pay attention to the highlighted section of the decision notice. If there is no claim for income compensation, then make sure you indicate that you do not accept that the employer is liable for payment of income compensation.

If you don’t have it in your claims system already, insurers and other claim managers might want to implement an easy way of marking a claim as an “incapacity claim” or not to make it easier to identify if there is a recurrence down the track.

The pain strikes back

If a worker does not initially have an incapacity claim, but later receives a certificate of capacity which indicates a downgrade in capacity (i.e. the worker now has some capacity or no capacity), then that is a “subsequent certificate of capacity” as defined in section 33 of the WCIMA 2023 and regulation 21.

This certificate of capacity automatically amends the claim to become an “incapacity claim” and the fun begins administrative process under section 28 must be followed:

- The employer has 7 days to give the certificate to the insurer.

- Once the insurer receives the certificate, the claim is amended.

- The insurer then has 14 days to issue a liability decision notice (accepted, deferred, disputed).

- If liability is deferred, then a provisional payments date is set and time starts ticking.

Dé jà boo boo

But what about if the worker has already received income compensation, returns to work (hooray!) and then later gets a downgraded capacity (boo)?

In this case, section 33 and regulation 21 do not appear to apply. This means that no legislative notices need to be issued.

However, from a claim management perspective, you still need to make a decision about whether or not you are going to start paying income compensation under the open claim for the period of incapacity.

This might require the gathering of additional witness evidence, or arranging further medical reviews and you should communicate with the worker about your intention to investigation and your decision (to accept and pay, or to defer and investigate, or to dispute liability).

This advice does not need to be given in a formal notice under the WCIMA 2023 and we do not recommend that you repurpose the liability decision notices for use with recurrence claims. It just causes confusion.

It is essentially the same process you follow when the worker presents medical & health expenses for consideration throughout the course of their claim, so just make sure you communicate with the worker in the same way.

There may be occasions where you determine that the worker is not entitled to income compensation under the open claim, but might be entitled to income compensation for a fresh claim. For example, if there was a new incident at work that has caused a compensable aggravation or recurrence or a completely new injury.

If you form that view (but the worker has not submitted a new claim form) you will need to decide whether to:

- dispute liability to pay income compensation under the open claim (and stay silent on the worker’s ability to make a new claim), or

- invite the worker to submit a new claim form and first certificate of capacity and the

fun beginsadministrative process under section 28 must be followed.

But you haven’t mentioned the recurrence claim form…

A “recurrence claim form” is not a legislated form. This is a document that insurance companies and employers have created to assist with gathering information and making decisions when circumstances change.

It is a handy tool and you can still use your recurrence claim forms to gather information, but just remember that there is no legal requirement for the worker to complete the form. Having said that, if a worker does not complete the form, you may decide that this means you don’t have enough information to accept liability to pay income compensation for the new period of incapacity.

This article was written by Erica Thuijs | Partner Insurance & Risk.

For specific advice please contact Erica Thuijs or a member of the Insurance & Risk Team.